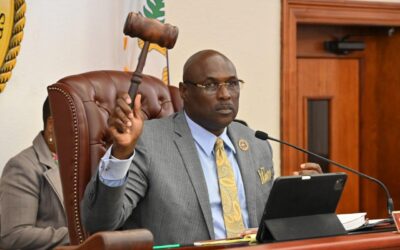

ST. THOMAS – The Committee on Budget, Appropriations, and Finance, under the leadership of Senator Donna A. Frett-Gregory convened in the Earle B. Ottley Legislative Hall. Lawmakers considered lease agreements and received testimony from the Government’s Financial Team on the financial overview of the Government of the Virgin Islands. All leases on today’s agenda were approved and will be sent to the Committee on Rules and Judiciary for further consideration.

Lawmakers considered Bill No. 35-0211, an act approving the Lease Agreement between the Government of the Virgin Islands, acting through its Commissioner of the Department of Property and Procurement, and James O. Gaston for Plot No. 9-G VICORP Lands, Prince Quarter, St. Croix, Virgin Islands, consisting of approximately 653,400 U.S. sq. ft. or 15 U.S. acres of unimproved land, more or less, as shown on Drawing No. A9-5-C-008 to be used for crop production and rearing small livestock. Additionally, Bill No. 35-0225, an act approving the multi-year lease agreement between the Government of the Virgin Islands, acting through its Commissioner of the Department of Property and Procurement, and Virgin Islands Centre for Architecture, Crafts and Build Heritage, St. Croix, Inc. d/b/a Virgin Islands Architecture Center for Built Heritage and Crafts, for Plot No. 8 Church Street and Plots No. 21, 22, and 23 Hospital Street, Christiansted Town, Company Quarter, St. Croix, U.S. Virgin Islands, consisting of two, two-story masonry buildings to be used for the common good, welfare, and education of the people of the Virgin Islands on heritage and cultural legacy, and for other related purposes. Both measures were proposed by Senator Novelle E. Francis, Jr. by request of the Governor.

William A. Harris, Property manager of the Property Division for the Virgin Islands Department of Property and Procurement delivered testimony on the measures. Harris detailed that the terms of the lease would commence on the first day of the month following the approval of the Governor and the Legislature of the Virgin Islands. The rent payable under the leases would, after individual grace periods be adjusted annually, including any renewal term, in accordance with the Consumer Price Index (CPI) increase established by the US Department of Labor, Bureau of Labor Statistics. These lease agreements all require a minimum of one hundred thousand dollars (James O. Gaston) and One Million Dollars (Virgin Islands Architecture Center for Built Heritage and Crafts) for all limits of general coverage. The Department of Property and Procurement, as the premises owner, is required to execute all permits and licenses required for the premises.

The lease agreement between James O. Gaston and the GVI acting through the DPP is for Parcel No 9-G VICORP Lands, Prince Quarter, St. Croix, US Virgin Islands, consisting of 653,400 US sq. Feet or 15.00 U.S. Acres of unimproved land, more or less. The property would be used for the purpose of crop production and the rearing of livestock. The term of the agreement is for twenty years, and the lease agreement provides for one- and ten-year renewal option. The annual rent for the referenced parcel would be two hundred twenty-five dollars and zero cents during the term of the lease.

The lease agreement between the Virgin Islands Architecture Center for Built Heritage and Crafts and the GVI is for Plots Nos. 8 Church Street and 21, 22, and 23 Hospital Street, Christiansted Town, Company Quarter, St. Croix, US Virgin Islands, consisting of two, two story masonry buildings, known as building 1 and 2, residing on 92,347.2 US sq. feet or 2.12 US Acres of improved land, more or less. The property would be used to promote the common good, welfare, and education of the people of the US Virgin Islands community on its heritage and cultural legacy. The term of this agreement is for 50 years, and the lease agreement provides an option for three additional terms of ten years. The annual rent for the parcel would be $1,200 payable in equal monthly installments of one hundred dollars and zero cents during the term of the lease.

Additionally, the committee considered Bill No. 35-0077, an act approving the lease agreement between the Government of the Virgin Islands, acting through its Commissioner of the Department of Property and Procurement and St. Thomas Rescue, Inc., Parcel No. 146, Revised Submarine Base No. 6, Southwest Quarter, St. Thomas, Virgin Islands, consisting of a one-story building, on approximately 0.1899 U.S. acres of improved land more-or-less, zoned P, for the purpose of operating a long-term headquarters for all rescue related activities of the Lessee, and for other related purposes. Senator Novelle E. Francis Jr. proposed the measure. The measure was previously vetted but was held in committee due to concerns over the cost of the lease.

In Block Two, the Committee received testimony providing an update on the status of finances of the Government of the United States Virgin Islands. Jennifer O’Neal, the Director of the Office of Management and Budget delivered primary testimony on behalf of the Governor’s Financial Team. The GVI’s unaudited revenue collections for FY2023 was $942.4M. This was inclusive of income taxes of $516.7M, property taxes of $48M, Gross Receipts of $207M, and Hotel and Other Non-Hotel Taxes of $40.8M. There were transfers of ARPA funds to the General Fund for Revenue Loss totaling $48M for a total revenue amount of $990,421,531. Compared to FY 2022’s collections of $1,074,012,019, FY2023’s collections were lower by $83.6M or 8.4%. This figure did not include federal reimbursements and only represented new monies collected. The total FY 2023 budget appropriation was $1,037,117,327. The Office of Management and Budget released allotments in the amount of $1,013,848,645, leaving $23,268,683 unallotted. In comparison to revenues, the amount released ($1.013 Billion) exceeds revenues by $23.4M or 2.3%. The difference between revenues collected and the FY2023 appropriations was $46.7M, or 4.5%. The total revised budget appropriation for FY 2024 is 1,044,206,596. Of this appropriation, the Office of Management and Budget has released at total of $276,269,960. A total of $767,936,636 has not been allotted. All allotments to agencies have been released up to the fourth month, except for miscellaneous, which is on an ask basis. While allotments have been released, they have not been paid in their totality. As of January 17, 2024, the Department of Finance reports an outstanding allotment payment in the amount of $33.9 million to various agencies.

Funds from the American Rescue Plan Act have been utilized to include premium pay, retiree stipends, infrastructure projects and revenue replacement. Of the rewarded amount of $547 Million, $438 Million has been obligated. The remaining $108 Million is to be used for various projects such as infrastructure projects such as storm water and wastewater infrastructure maintenance. Additionally, through December 31, 2023, the interest earned on the Government of the Virgin Islands’ Money Market Fund at JP Morgan Bank is $8.1 Million. $3Million has been transferred to the general fund and recorded as interest incoming, and the balance remains in the account, compounding interest. The status of the 100M line of credit report included an amount drawn of $60.9 Million, a total repayment of about $3.7 million, with an outstanding balance of 57.2 million. Approximately $42.7 million is available. The Tourism Advertising Revolving Fund as of January 12, 2024 had an available budget amount of $61,951,304.

Senator Donna A. Frett Gregory voiced concern over the issuance of retroactive payments that were promised to eligible parties. Stating that “data drives decisions,” she urged the Governor’s Financial Team to provide accurate information as it pertained to the financial status of the Government of the United States Virgin Islands.

Of the $25 Million appropriated for retroactive payments, only $2.5 million has been paid. Payments were made to 972 people with 7,951 remaining to be paid. Of the 972 people paid, 487 people were owed less than $2,000, for a total of $554,267. The Government of the Virgin Islands, through the Single Payer Utility Fund, owes WAPA $3.5 Million with over $16M being owed by entities outside of the central government payer process. Of the $16M, approximately $11M is owed between the hospital facilities and the Virgin Islands Waste Management Authority. It was noted that the central government is current with its utility payments to WAPA, with only $3.5 million outstanding.

Senators present at today’s committee hearing included Donna A. Frett-Gregory, Novelle E. Francis, Jr., Marvin A. Blyden, Samuel Carriόn, Diane T. Capehart, Dwayne M. Degraff, Ray Fonseca, Alma Francis Heyliger, Kenneth L. Gittens, Javan E. James, Sr., Marise C. James, Franklin D. Johnson, and Carla J. Joseph, and Milton E. Potter.

The Division of Public Affairs is committed to providing the community with accurate information on proceedings at the Legislature of the Virgin Islands. Visit legvi.org.

####