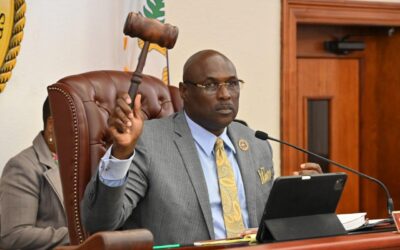

ST. THOMAS – The Committee on Budget, Appropriations, and Finance, Chaired by Senator Donna A. Frett-Gregory met in the Earle B. Ottley Legislative Hall. Lawmakers met to receive closeout testimony from the Governor’s Financial Team on the proposed Fiscal Year 2025 Executive Budget for the Government of the Virgin Islands of the United States.

Kevin McCurdy, Commissioner of the Department of Finance delivered primary testimony on behalf of the Governor’s Financial Team. An updated budget of $925,210,110 for Fiscal Year 2025 for the General Fund, with no change to all other categories for a total proposed budget of $1,468,969,322, resulting in a net change of $28,407,100. McCurdy said a thorough analysis of all departments and agencies was done to ensure all critical items for the fiscal year were captured. Initial revenue projections have increased from $897 Million to $925 million. An addition of $17 million has been projected for the health insurance increase under CIGNA and United HealthCare, an additional $5.9 million towards the miscellaneous wage adjustment line item by bringing the total to $10 Million. McCurdy stated that the USVI Economy performed incredibly well in 2024, as evidenced by a record low unemployment rate, economic output, and solid tourism performance. It is expected that the USVI will remain on this positive trajectory. During the Budget Overview delivered on June 6, 2024, a total appropriated and non-appropriated budget of $1,440,562,222 for Fiscal Year 2025 was presented. This amount reflected $896,803,010 for the General Fund, $97,949,177 for Other Appropriated Funds, $28,940,041 in Other Non-Appropriated Funds, and $416,839,994 for Non-Disaster Related Federal Funds.

There were 10,098 government employees. The current central government employee population is 6,262. There are 3,215 employees in the St. Thomas-St. John District and 3,047 employees in the St. Croix District. There are 1,377 unclassified and 4,253 classified employees, 89 part time, 253 per diem and 20 temporary employees. The Division of Personnel has processed 796 hires and 402 separations. There are 14,328 covered Group Health Insurance members. 7,205 are active and 7,213 are retiree enrollment. McCurdy stated that the government will remain committed to strategic and conservative budgeting. It is expected that outcome-based budgeting will be live by Fiscal Year 2026. McCurdy urged the body to limit additional appropriations throughout the next fiscal year, stating that it would often lead to an unfunded mandate when the operating budget aligns with projected revenues.

Additionally, lawmakers received testimony concerning the financial status of the Virgin Islands Government Employees Retirement System. Angel Dawson Jr., administrator/and Chief Executive Officer of the Government Employees Retirement System delivered testimony. Dawson informed the body of the reorganization of the entity. The GERS is currently in the process of expanding its appeal, which is currently constructing a 126-room Hampton Hotel. The GERS also began the resumption of personal loans to qualifying active members on a limited basis. The funding allocation for Fiscal Year 2024 was $20 Million, with $10 Million available per district. On April 9, 2024, after extensive testing and preparation, the GERS started accepting expressions of interest in loans for pre-screening purposes and actual applications later that month. By Mid-July 2024, 1,501 personal loans totaling some $14,555,935 had been processed. 714 loans totaling $6,913,960 were made in the St. Thomas – St. John District and 787 Loans totaling $7,641,975 were made in the St. Croix District. On July 8, the personal loan programs to utilize the remaining allocation. In total, 1,034 loans were dispersed in the St. Croix District, totaling $9,994,665 and 996 loans in the St. Thomas/St. John District totaling $9,7111,244.

During the August 15, 2024 retiree payroll, the GERS paid benefits to 8,770 retirees and beneficiaries. From October 1, 2023, through August 15, 2024, 278 retirees were added to the payroll and during that same period, 268 deceased retirees were removed from the payroll. The total amount paid in benefits from October 1, 2023, through August 15, 2024, was $235,638,905.93. The average monthly paid to the retirees and beneficiaries is more than $22 Million. As of August 15, 2024, the active membership was 8,992. (Central government $6,259, and semi-autonomous agencies $2,733.) As of August 31, 2024, the outstanding employee deductions and employer contributions were $15.9 million, with $5 Million in interest and penalties, totaling $20.9 Million, and $6.3 Million from the RLSH, with, $508.4K in Employee Contributions, and 22,000 in other Deductions, and $1.1 Million in interests and penalties, and 8.0 million total due.

Although Dawson stated that the GERS was able to sustain a shortfall in Fiscal Year 2024, if a similar shortfall was to happen for two more years, it is possible that the GERS will face a possibility of a temporary insolvency between 2037 and 2039. The GERS Board of Trustees is authorized to increase employer contributions from the current 23.5% to 26.5% Effective January 1, 2025. This would yield an approximately an additional $13 Million for the GERS. Additionally, there is a scenario in which GERS would not face any insolvency, even if there is a $34 Million shortfall. Under this scenario, the Legislature would rescind Act. No. 6233 and resume funding the GERS’ annual $15 Million administrative expenses as it previously did. The GERS is not required to submit a budget to the Legislature for approval. The Board of Trustees is responsible for approving the GERS’s annual budget. As of July 31, 2024, the market value of the portfolio was $524.1 Million, which includes Domestic Equity Assets of $202 million International Equity Assets of $89 million, Domestic Fixed Income Assets of $136 million, Alternative Investment Assets (Private Equity-Limited Partnership) of $6.6 million, Cash – $5.6 million, other alternative investments (real estate, local investments, and member loans) of $84.9 million. Fiscal Year to date, $145 Million has been withdrawn from the portfolio, including $125 million to cover benefits and expenses, and $20 million to fund the restart of the member loans program. As of July 31, 2024, the member loan portfolio consisted of 2,574 personal loans, including 2,209 active members and 296 legacy retiree loans, totaling $21.3 million, 49 legacy mortgages of $2.7 million and 23 legacy land loans of $344,0000. The overall loan portfolio as of July 31, 2024, is $24.4 Million. Dawson said GERS saw its first positive net cash flow for the first time since 1995.

Senators present at today’s committee hearing included Donna A. Frett-Gregory, Novelle E. Francis, Jr., Marvin A. Blyden, Samuel Carriόn, Diane T. Capehart, Dwayne M. Degraff, Alma Francis Heyliger, Ray Fonseca, Kenneth L. Gittens, Javan E. James, Sr., Franklin D. Johnson, and Carla J. Joseph.

The Division of Public Affairs is committed to providing the community with accurate information on legislative proceedings and other events at the Legislature of the Virgin Islands. Visit legvi.org.

####